Our Leaders

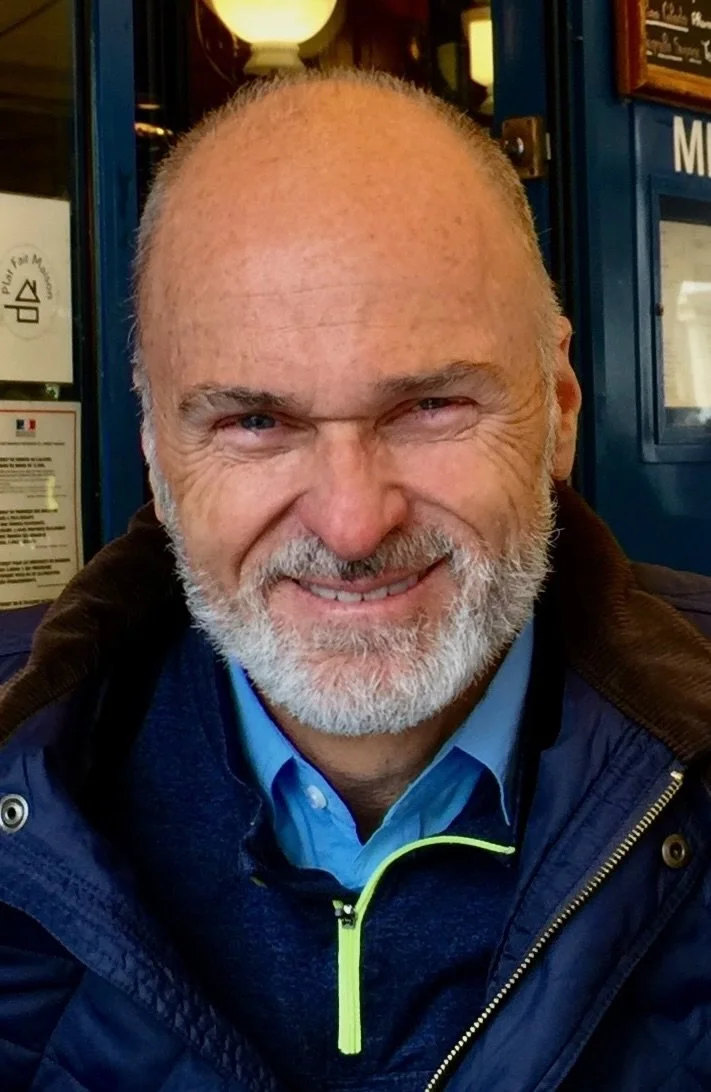

Jeff Johnson

Jeff Johnson is the Founder and Managing Partner of Lakeshore Holdings LLC, a real estate investment firm specializing in commercial real estate, private equity, and sustainable energy investments. He has been responsible for over $70 billion in accretive investment transactions, emphasizing acquisitions, dispositions, and portfolio repositioning. Lakeshore Holdings is in the process of growing a sustainable energy company, focused on solar energy investing.

Jeff served as Chief Investment Officer and Chairman of the Investment Committee at Equity Office Properties Trust, a Fortune 500 company. Under his leadership, Equity Office completed its Initial Public Offering (IPO), grew by 600% over 10 years, outperformed the public REIT index, and was sold for $39 billion at the peak of the REIT market.

Additionally, Jeff co-founded Lehman Brothers’ first global real estate private equity fund, raising $1.6 billion in equity. This fund delivered over a 30% annualized return to shareholders, exceeding industry benchmarks.

As Chief Executive Officer of Dividend Capital Diversified Trust Fund (now “AREIT”), Jeff led the transformation of a $2.5 billion underperforming, nontraded public REIT into the largest and best preforming Daily NAV REIT.

Jeff has advised major organizations such as Strategic Value Partners, Washington Prime Group as Interim Chairman, and The Irvine Company. His for-profit board experience includes Washington Prime Group, Wright-Runstad Company, Prescient, and Captivate. He has served on numerous not-for-profit boards, including Denison University, The Nature Conservancy, the Kellogg Real Estate Advisory Board, and the White Flag Foundation.

Jeff holds a B.A. with honors in Economics from Denison University, and an MBA from Northwestern University’s Kellogg School of Management.

Megan K. Kelleher

Megan K. Kelleher has been involved with Lakeshore since 2009 and is Managing Partner and co-founder of Two North Consulting (“2NC”), a firm specializing in commercial real estate valuation, underwriting, and due diligence since 2007.

2NC has underwritten, negotiated, and performed due diligence on over $10 billion of office investments. Ms. Kelleher worked with Mr. Johnson at Equity Office as Vice President – Investments and co-head of dispositions, where she was responsible for the sale of over $3 billion of assets. Prior to leading dispositions, she headed acquisitions for the Southeast region; initially she was an underwriter on the Due Diligence team.

Ms. Kelleher holds an undergraduate degree from Indiana University - Bloomington and an MBA from Loyola University.

Sandy Deets

Sandy Deets has been involved with Lakeshore since 2009. She also worked with Mr. Johnson at Equity Office and at AREIT* overseeing all underwriting and due diligence activities related to acquisitions, dispositions, developments, joint ventures, and mergers. She managed a large pipeline of deal activity and underwrote over $50 billion in acquisitions and dispositions, completing due diligence on over $25 billion in transactions. In addition to her transactional responsibilities, Sandy directed the $3 billion corporate budget and quarterly earnings forecasts for Equity Office. Ms. Deets has held similar leadership positions at Green Courte Partners, Starwood Retail Partners, Cushman & Wakefield, and Commonwealth Realty Advisors.

Ms. Deets holds an undergraduate degree in Finance from Indiana University - Bloomington and an MBA from Loyola University.

*AREIT was known as Dividend Capital Diversified Fund (ticker: DPFIX) during Jeff and Sandy’s tenure